Impact Investing In Children’s Mental Health In Texas

Targeted Returns

The ROC Care Fund is designed to provide monthly profit distributions. When combined with a targeted exit strategy, the fund is projected to deliver a 20.2x return over its duration.

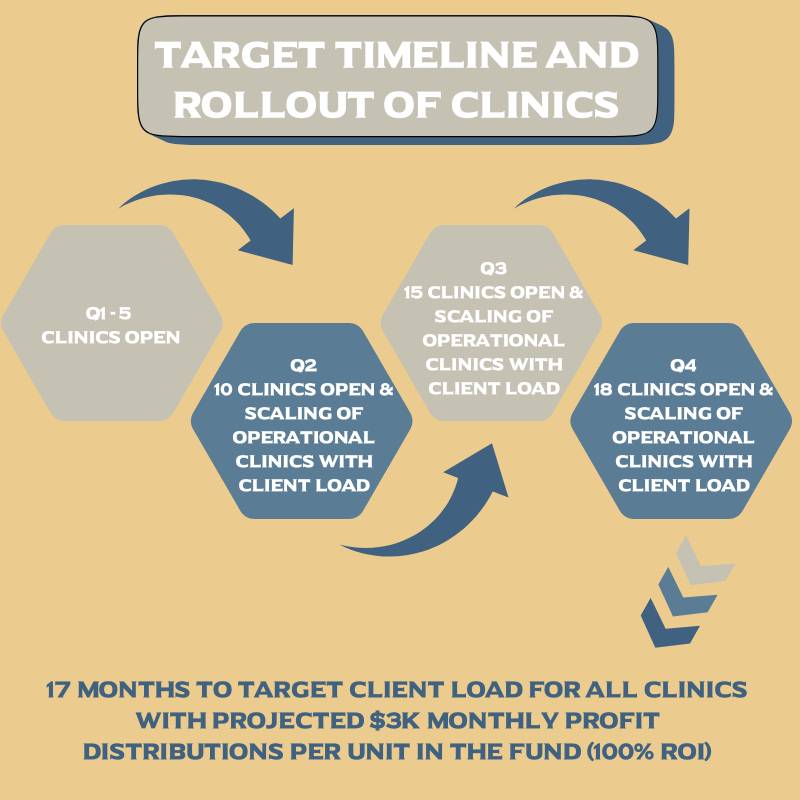

17

Months to 100% ROI

Based on the execution of our operating model, the ROC Care Fund projects that investors will achieve a 100% ROI within 17 months of the clinics go-live date.

Our Mission

The ROC Care Fund is committed to expanding access to life-changing behavioral and mental health services for children on Medicaid by strategically investing in Texas Care Center franchise locations. Our mission is to create lasting impact by connecting investors with an opportunity to drive both financial growth and social change. Through a scalable, centrally managed model, we ensure sustainable clinic operations that strengthen families, empower communities, and deliver meaningful returns.

Take a moment to watch an overview of the ROC Care Fund presented by Josh Smith, GP of the fund. The ROC Care Fund is providing access to mental and behavioral health services in Texas, filling an urgent and profitable need.

Investment Opportunity

The Financials

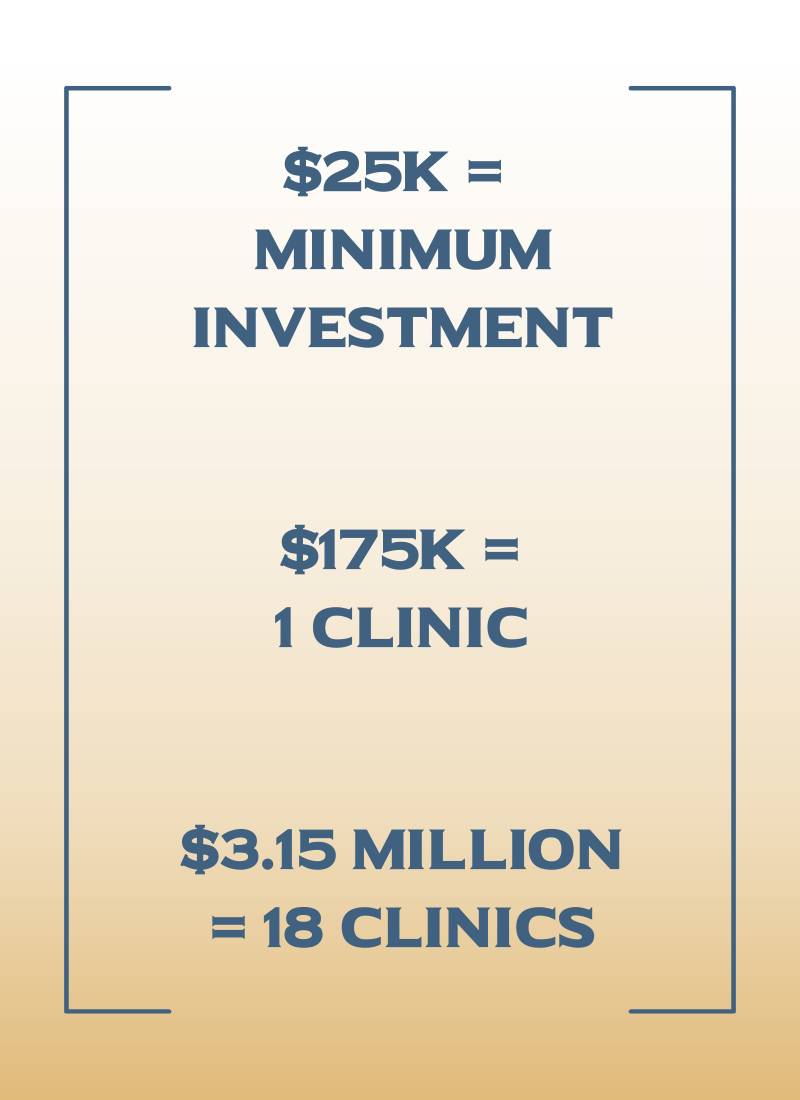

Minimum Investment

Each unit in the Fund is $25,000. We have a current targeted raise of $3.15M to open an additional 18 Texas Care locations.

Timelines

Leveraging our ‘Managing Partner Agreement’ we are able to open clinic locations in 4-6 months. Once the clinics are open and operational, profit distributions begin the 15th of each month based on the preceding month’s Net Profit.

Return on Investment

As we scale our network of clinics, we project that each investment unit in the fund will see ROI’s of:

- Year 0 (Build Year) – 13%

- Year 1 – 109%

- Year 2+ – 157%

The Mental and Behavioral Health Crisis In Texas

Diving into the WHY...

%

Texas Counties in Crisis

Texas ranks last in the nation in terms of accesss to mental and behavioral health. The gap is so large, that 97% of all of the counties in Texas have declared a Mental Health State of Emergency.

Months To Obtain Assessment

Due to the massive shortage of providers willing to accept Medicaid patients, many children are waiting 3 – 12+ months to even be assessed by a clinician.

%

Texas Youth Contemplating Suicide

Far too many youth in Texas are unable to receive the mental and behavioral health treatment they so desperately need. 2 out 3 children who have been diagnosed with major depression are not receiving treatment!

ROC Care Fund/Texas Care Clinics

Current And Future Locations

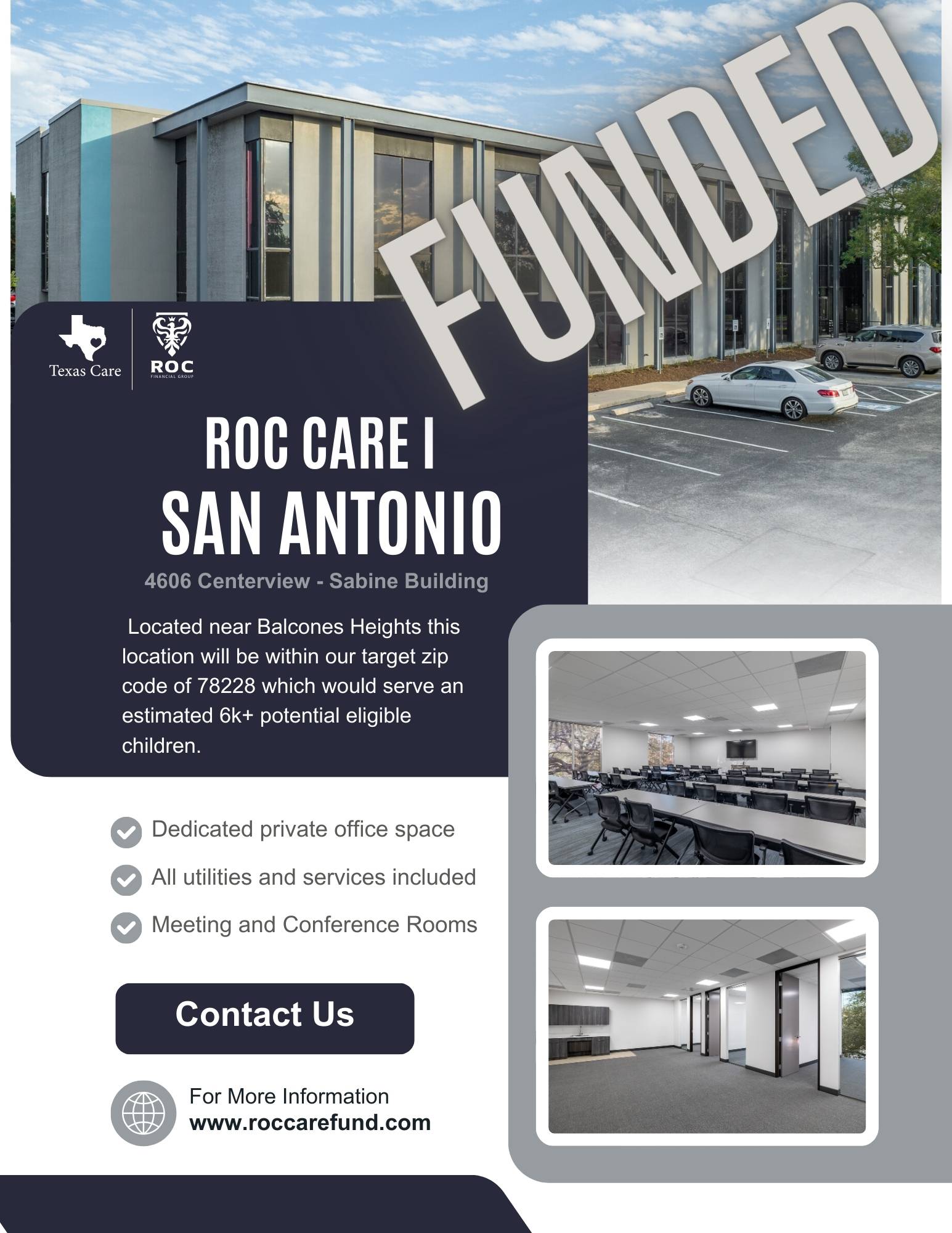

SATX - Balcones Heights

Balcones Heights has an urgent need for the services provided through Texas Care. This site has begun the accreditation process, and has a target opening of May, 2025.

$14,000 Per Fund Unit

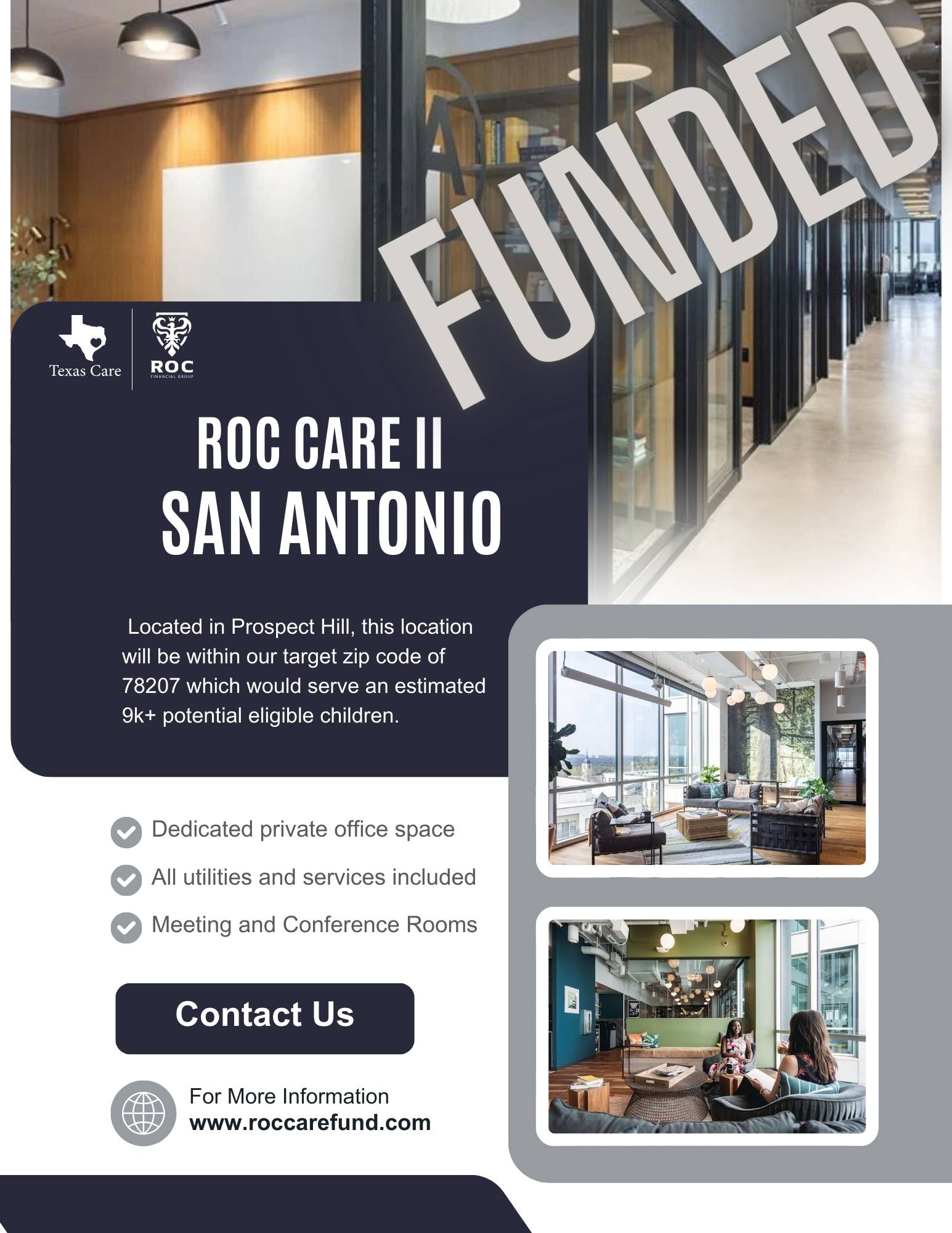

SATX - Prospect Hill

With a population of over 50k residents, Propect Hill area is our site for clinic #2. This clinic is currently working through accreditation, and has a target launch date of June, 2025.

$17,000 Per Fund Unit

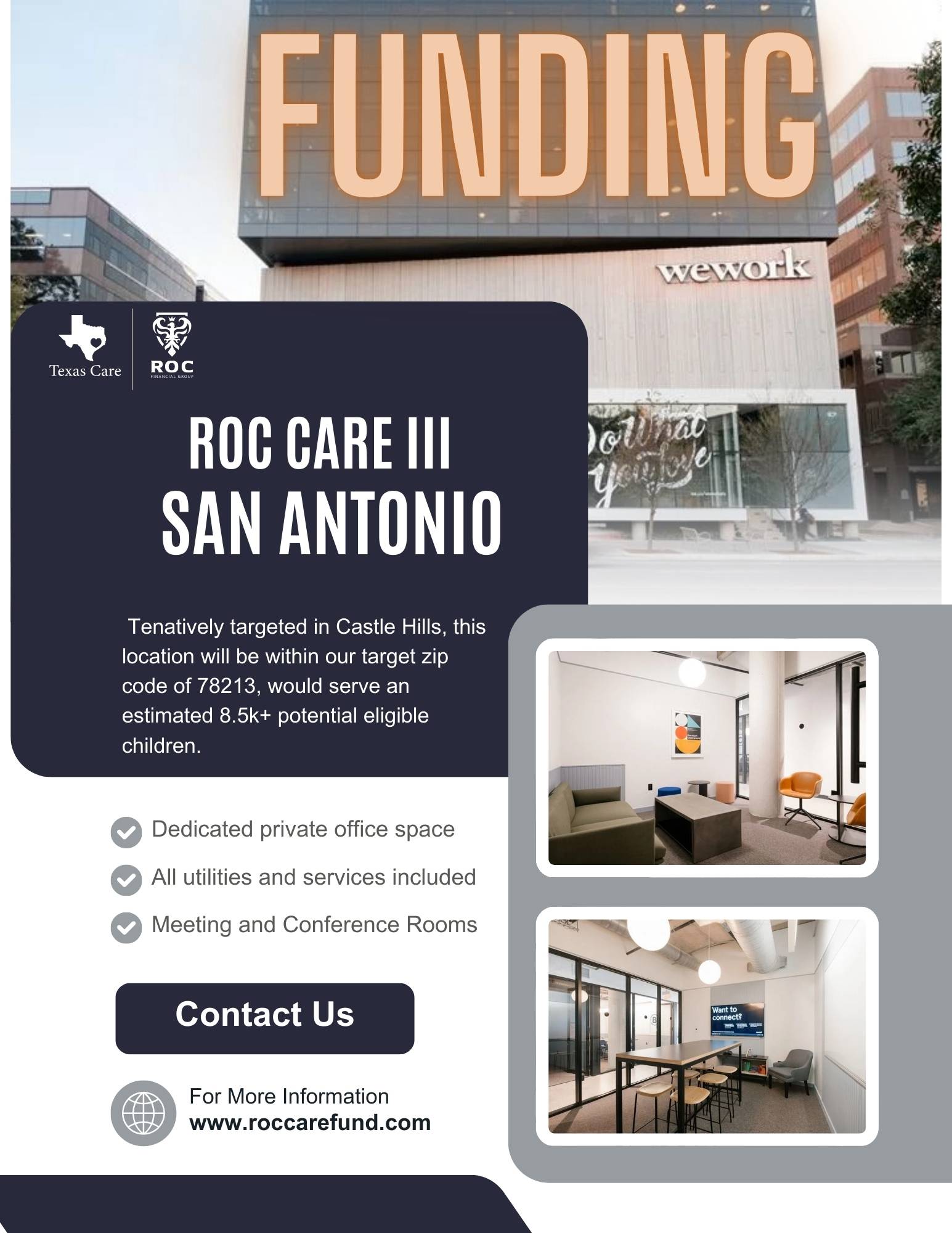

SATX - Clinic #3+

As we continue to fund locations, we will target locations that have the greatest need for Texas Care support. We antipate launching the next traunch of locations in Q3, 2025.

$25,000 Per Fund Unit

SCHEDULE A CALL

If you’re looking for a way to generate passive returns while making a meaningful difference in underserved communities, let’s connect. We’d love to share how the ROC Care Fund is creating both financial success and lasting impact.

Book a time with us today—we look forward to the conversation.

– Josh Smith (GP) &

Daven Michaels (GP)

Josh Smith - General Partner

Joshua C. Smith is the founder of the ROC Fund and co-creator of Texas Care Centers, leveraging over 25 years of leadership experience with companies like Capital One, HSBC, and Ferguson Enterprises. With a proven track record in building scalable operations and driving financial growth, Josh combines strategic expertise with a passion for community impact. Through the ROC Fund, he connects investors to stable returns while addressing Texas’s critical mental health needs, creating a unique opportunity to align financial success with meaningful change.

Daven Michaels - General Partner

Daven Michaels is a seasoned entrepreneur, investor, and executive chairman with a proven history of building and scaling successful businesses. As the founder of “123Employee,” a leading BPO for small businesses, and “Michaels Press,” a publishing house with national distribution, he brings extensive experience in operational growth and strategic development. Daven’s entrepreneurial expertise, combined with his ability to create and lead dynamic teams, makes him a key asset in developing Texas Care in San Antonio & beyond.

Join us in expanding access to life-changing mental and behavioral health services for children while generating passive returns. The ROC Care Fund offers a unique opportunity to create both financial success and lasting social change. Be part of the movement—invest today.

NOTICE: NOT AN OFFER TO SELL OR A SOLICITATION TO BUY. AVAILABLE TO ACCREDITED INVESTORS AND/OR OTHERWISE QUALIFIED INVESTORS ONLY PER REGULATION D PROMULGATED UNDER THE SECURITIES ACT OF 1933, AS AMENDED, AND/OR OTHER APPLICABLE U.S. FEDERAL AND STATE EXEMPTIONS FROM REGISTRATION.

The material and content presented herein is qualified in its entirety by a private placement memorandum (the “Memorandum”) which contains more complete information including risk factors. The material and content herein contains forward-looking statements and hypothetical economic forecasts that may not be realized. By receiving or viewing this material, you acknowledge and agree not to rely upon it in making an investment decision. Please read the Memorandum. This material and content do not constitute or form a part of any offer to sell or solicitation to buy securities nor shall it or any part of it form the basis of any contract or commitment whatsoever. Without limiting the foregoing, this material and content do not constitute an offer or solicitation in any jurisdiction in which such an offer or solicitation is not permitted under applicable law or to any person or entity who is not an “accredited investor” as defined under Rule 501(a) of the U.S. Securities Act of 1933, as amended, and/or who does not possess the necessary qualifications described in the Memorandum and/or applicable exemptions under the U.S. Securities Act of 1933, as amended. Please read the Memorandum.